Pay by cash, debit or cheque.

Credit cards are not accepted.

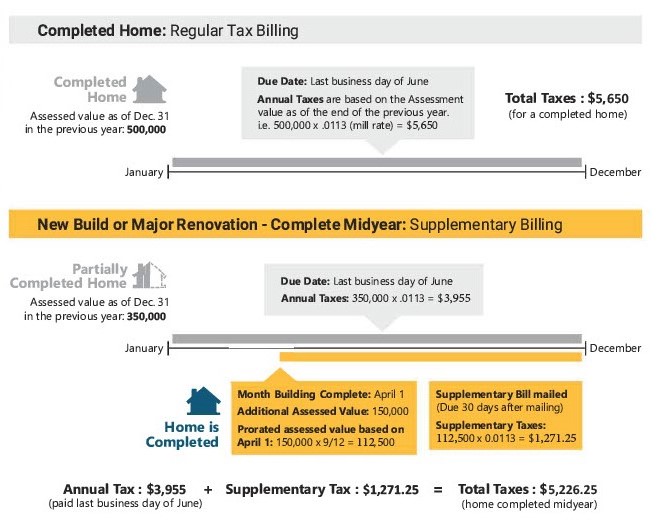

Supplementary Tax

A supplementary tax bill is issued when a new improvement to a property is completed or occupied during the current calendar year. Supplementary tax is based on the increase in value, from the annual assessment (prior year-end value) to the value upon completion or occupancy.

The supplementary tax is prorated from the time of completion or occupancy to the end of the current calendar year. Supplementary tax notices are mailed out in the Fall and payment is required within 30 days of mailout. Taxes paid after the due date will be assessed a penalty of 1% for each outstanding month (to December 1st).

Methods of Payment

910 4th Ave S,

Lethbridge AB,

T1J 0P6

Make the cheque payable to The City of Lethbridge. Do not send cash.

Your account number is your 13-digit roll number. Select "Lethbridge (City of) Taxes."

Allow 2-3 business days for processing.

For a fee, you can pay online using your MasterCard or Visa by visiting lethbridge.ca/pay.

Allow 1-2 business days for processing.

Paying through your Mortgage or TIPP

Mortgage:

You must contact your mortgage company to ensure they are collecting sufficient funds. Your mortgage company will not be contacted by the City of Lethbridge.

TIPP:

Supplementary levies and any estimated increase in taxes will be recalculated in your TIPP payment. Click here for more information on the TIPP program.

Contact Us

City Hall

910 4 Avenue South

Lethbridge, AB T1J 0P6

Phone: 311

or 403-320-3111 (if outside of Lethbridge)