Your property assessment is an estimate of the price your property may have sold for on the open market by a willing seller to a willing buyer as of July 1 of the previous year. Assessed values reflect the physical condition of the property as of December 31, of the previous year.

Property Assessments

Request for Information (RFI) Surveys

If you are not the property owner, have the owner fill out the Agent Authorization for Assessment Form.

Multi-family RFI Survey

As part of our commitment to ensuring the highest degree of accuracy for our annual assessments, we conduct ongoing market research which includes tenant/occupancy status of individual properties and the details relating to such. Accurately researching occupancy/tenancy, rental rates, operating costs, and vacancy is a vital component in monitoring our local marketplace. The end goal is to provide our stakeholders with realistic, fair and equitable assessment valuations based upon market evidence. We are asking for your assistance in achieving this commitment.

We are conducting our annual survey with the intent to verify our existing occupancy records and to accurately measure market parameters which affect value. The data we collect is vital to our analysis and forms an integral component within our valuation process. If the property or unit is owner occupied or vacant, please provide information stating so.

Non-residential RFI Survey

As part of our commitment to ensuring the highest degree of accuracy for our annual assessments, we conduct ongoing market research which includes tenant/occupancy status of individual properties and the details relating to such. Accurately researching occupancy/tenancy, rental rates, operating costs and vacancy is a vital component in monitoring our local marketplace. The end goal is to provide our stakeholders with realistic, fair and equitable assessment valuations based upon market evidence. We are asking for your assistance in achieving this commitment.

We are conducting our annual survey with the intent to verify our existing occupancy records and to accurately measure market parameters which affect value. The data we collect is vital to our analysis and forms an integral component within our valuation process.

Even if the property or unit is owner occupied or vacant, you must provide information stating so.

To meet the Provincial Government audit guidelines, and to assist in calculating fair assessments for all property, the assessment office must update recorded property characteristics at least once every five years. Assessors have various ways to collect information, one way is self-reporting by the property owner. The assessment department identifies specific areas each year to send a Residential Request for Information (RFI) to.

If you were selected to complete the online Residential Request for Information, please have your roll and the survey key ready.

Residential RFI Survey

Annual lease: a lease that has a specific start and end date.

Appraisal: the money value of property as estimated by an appraiser.

Building insurance: the annual cost of an insurance policy that covers the cost of repairing damage to the physical structure.

Gross lease: a lease where the landlord receives a specific rent and pays the cost of operating and maintaining the leased property.

Lease: A written contract where the owner allows a tenant to occupy and use their property for a certain period of time and for a specific rent.

Monthly lease: is in reference to a month-to-month lease, which is a short term leases that may or may not be in written form. This type of lease has no definitive end date and is generally renewed on a monthly basis.

Non Arm's-length lease: a lease were the tenant and landlord are related.

Owner-occupied: units occupied by the owner of the property.

Percent rent: an agreement where the owner receives a percentage of gross sales of the business, on top of the base rent.

Semi-Gross lease: a lease where the landlord receives a specific rent and pays some of the cost of operating and maintaining the leased property.

Step-up: a lease that calls for set increases in rent at specified intervals.

Structural maintenance: the expenses required to keep the property operating and covers the repair of such items as the roof, water heaters, cooling systems, broken glass, and painting.

Triple net lease: a lease where the tenant pays the rent and all expenses of operating and maintaining the leased property (including taxes), but not including depreciation.

All definitions have been derived from the IAAO (International Association of Assessing Officers).

Property Assessment FAQs

What are the factors that affect a property assessment

As a municipality we are required to reassess all properties annually. Your current assessment is based on the market value as of July 1 of the previous year.

What are the factors that affect my property’s value?

- Style of home (examples: bungalow, bi-level)

- Size of home

- Size of the lot

- Age

- Basement or lower level finish

- Quality of construction

- Building condition

- Location & Site influences (examples: golf course, lake, coulee view)

- Other special features (examples: air conditioning, fireplaces, pools)

I paid $260,000 for my property. Why is it assessed for $267,000?

A range of sale prices results when similar properties are sold during the same time frame. Assessed values reflect the sales in the middle of this range of prices. That is why your assessed value may be higher or lower than the price you purchased your home for.

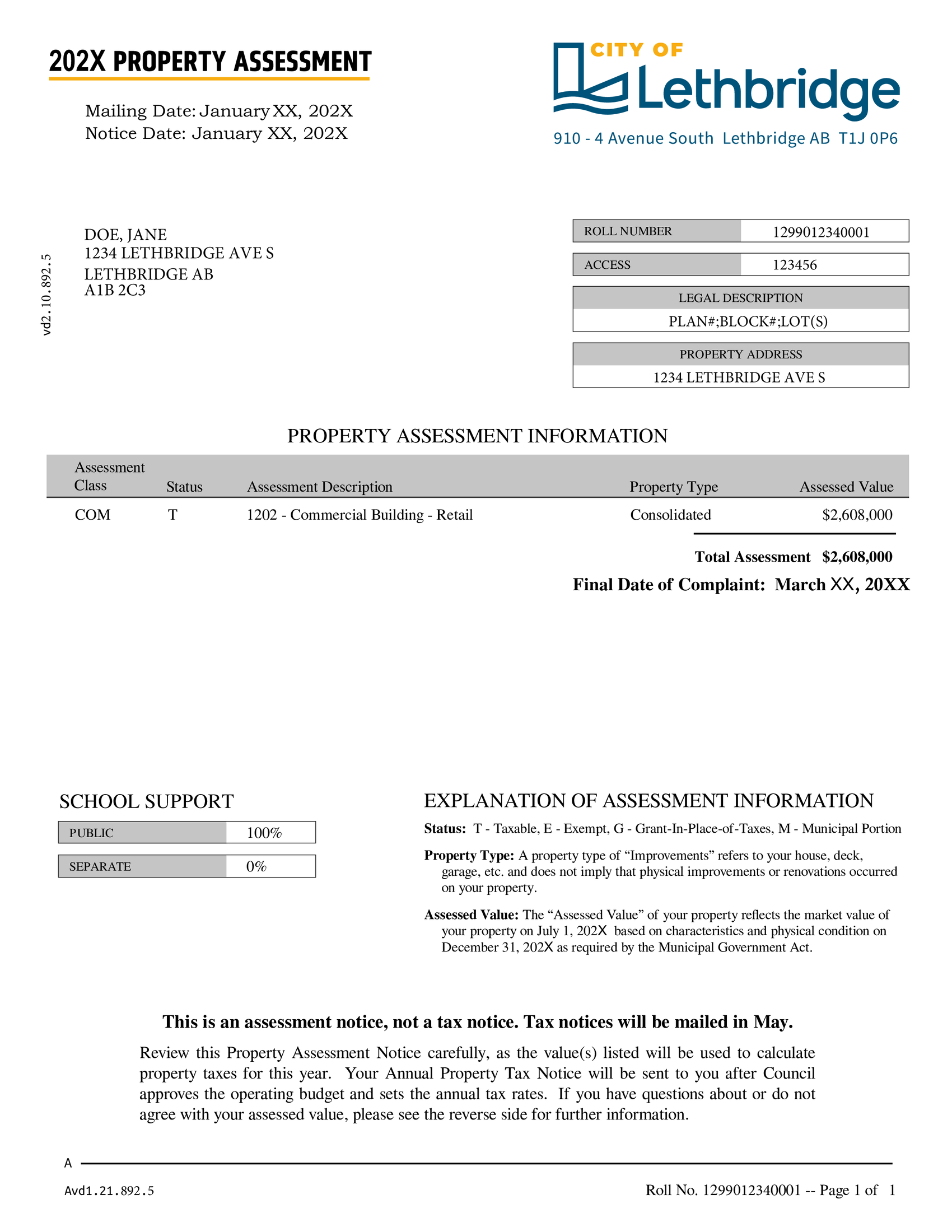

What is a property assessment notice?

This notice advises you of:

- Your new current assessed value

- Your tax classification and tax liability for Provincial Education, Green Acres, and Municipal taxes

- Your legal description (Plan;Block:Lot)

- Your declared school support

- Your complaint deadline

What was the average single family dwelling assessment change in my neighbourhood?

For the 2024 tax year, overall property assessments for single family dwellings increased by about 5.6% on average as of July 1, 2023, compared to the previous year's assessments.

What is a supplementary assessment notice?

A supplementary property assessment is done when a new building, renovation or an addition to an existing building is completed in the current calendar year. The supplementary tax bill will reflect the number of months the building was completed or occupied during the year. Check the Supplementary Brochure for more information.

Provincial legislation requires that your City apply the same tax rates to supplementary assessments that were applied for annual property tax purposes. This includes both the Municipal tax rate and the Provincial Education tax rate.

Your assessment is an estimate of the price your property may have sold for on the open market by a willing seller to a willing buyer, as of July 1, of the previous year.

Municipal Government Act Section 1(n), Province of Alberta

Why is my property assessment different every year?

Municipalities are required to reassess all properties annually. Your current assessment is based on the market value as of July 1 of the previous year.

How do I know my assessment is fair?

Assessed values are reviewed at three points in the valuation process:

-

By the City's internal checks and balances

-

By the Alberta Government's annual assessed audit process

-

By individual property owners' review of their notice

You may wish to use the Property Information WebMAP http://gis.lethbridge.ca/propertyinfo/ to compare your assessment to your neighbours and other similar properties that have recently sold. You can also contact your Assessment Department with any questions or for more details on your assessment. We would be happy to assist you and answer any inquiries.

Where can I find all the assessed values for the City?

All property assessments can be searched on the Property Information WebMAP.

OR

All assessed values included on the assessment roll are available at the Assessment and Taxation Office and include:

-

The property roll number

-

The type of property

-

The property address

-

The property legal description

-

The tax classification and liability

-

The assessed value

If you'd like detailed information on other properties, general property searches can be provided to you for $25, assessment summary reports for $30 for single family houses, and $50 on all other property types.

What can I do if I believe my assessment and property details are incorrect?

At your City's Assessment Department, we welcome any inquiries regarding your assessed value. If there are errors in the physical characteristics recorded, the appraiser will amend the assessment accordingly.

How do I appeal my property assessment?

Property owners have 60 days after the assessment notice date to make a complaint about their property assessment amount.

Property assessment amounts may be appealed, property tax amounts are not appealable.

How does the assessment department collect the information on properties in the City?

To meet Provincial Government audit guidelines, and to assist in calculating fair assessments for all property, the assessment office must update recorded property characteristics at least once every five years. Assessors have various ways to collect information, they include:

- Completing physical inspections of homes

- Requesting property owners to complete self-reporting requests for information (RFI)

- Review of sale and listing information

- Review of permits

- Use of the City aerial photography

- Complete outside inspections

Contact Us

City Hall

910 4 Avenue South

Lethbridge, AB T1J 0P6

Phone: 311

or 403-320-3111 (if outside of Lethbridge)