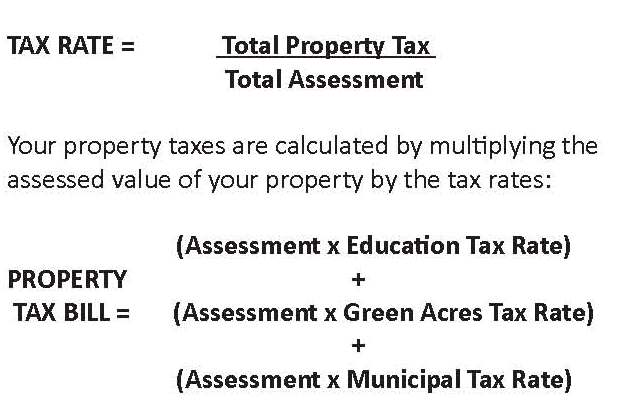

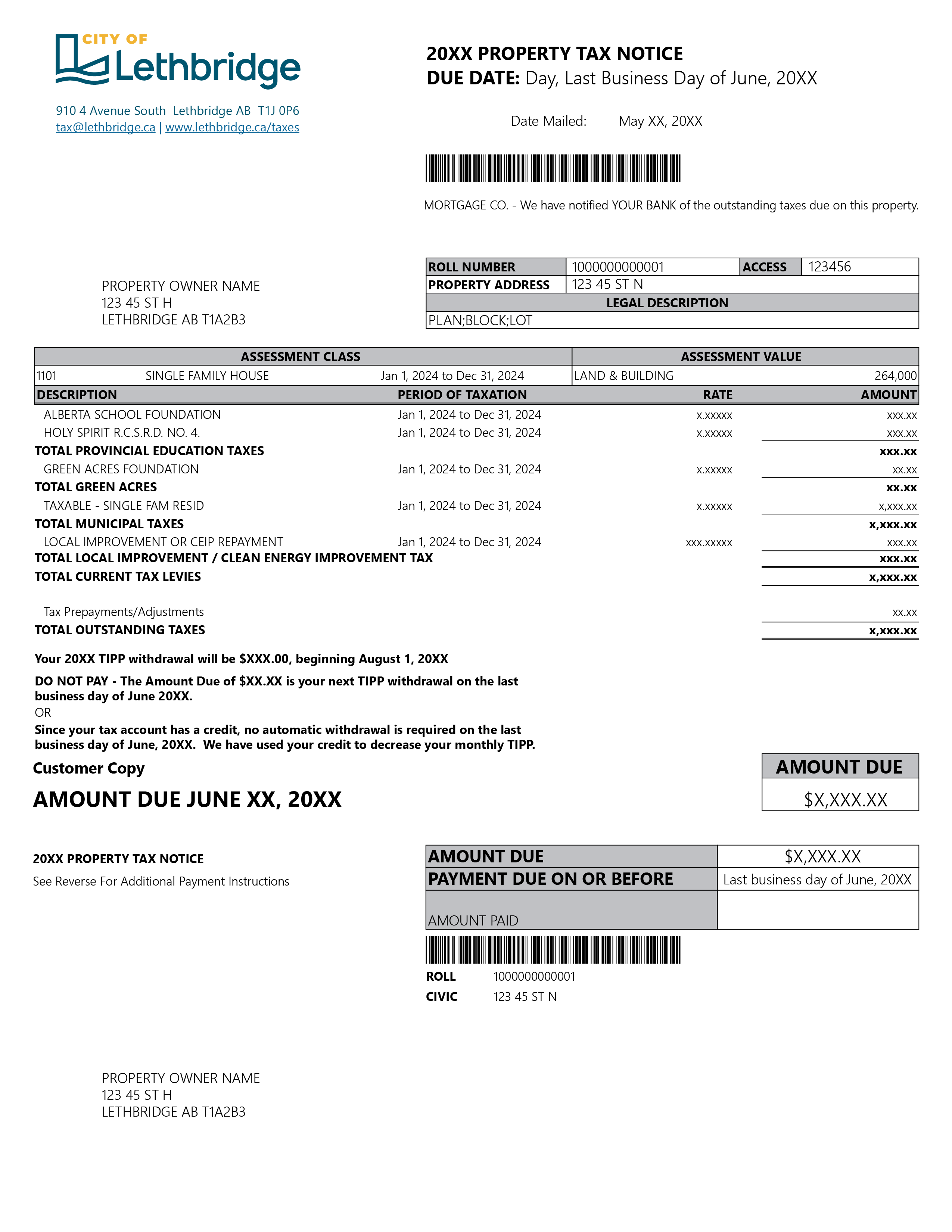

Property tax is a composite of several components, each serving a distinct purpose.

- Provincial Education (School) Levy: The Provincial Government determines the education tax for each municipality in Alberta. Your City is mandated to collect this tax on behalf of the Province.

- Green Acres Foundation Levy: This portion is determined by the Green Acres Foundation to support the operation of their senior facilities and services. Your City is required to collect this tax on behalf of the Foundation.

- Municipal Levy: Municipal property taxes fund crucial civic services, including police and fire protection, community services, parks and recreation, transit, roads, and other infrastructure.